There is a lot of discussion around the return one should expect on their corporate innovation program, but little or nothing is done to actually measure and control it. There are a variety of different ways to think about this. Some people talk about the “profitability” of innovation in terms of its EBITDA margin based on projects implemented; others use indicators such as the rate of renewal on a product portfolio (measured as the % of sales corresponding to products less than 5 years in the pipeline); others propose a straightforward ROI model, and there are those who simply use the traditional NPV (Net Present Value) and IRR (Internal Rate of Return) or payback period for each project that is part of the innovation portfolio.

Our recent experience with several clients provides important lessons in this area, including:

- It is necessary to make a very clear distinction between the value of the idea portfolio and the investment made to generate and incubate those same ideas. It is important to not envision the same return on each idea, but that the return is measured in relation to what it cost to gestate and incubate that same idea. The return on the portfolio should then always exceed the cost to process and manage it.

- The choice of KPI used to evaluate an innovation portfolio depends on the type of idea, innovation focus, sector or industry, and possibly other factors. Therefore it is important to have a “toolkit” of indicators and define the right “mix,” rather than apply a single indicator across the board.

Return on Innovation Portfolio

A critical point that we always stress with our customers is placing a value on the ideas in their innovation portfolio regardless of each idea’s stage of development or where it is in the incubation funnel.

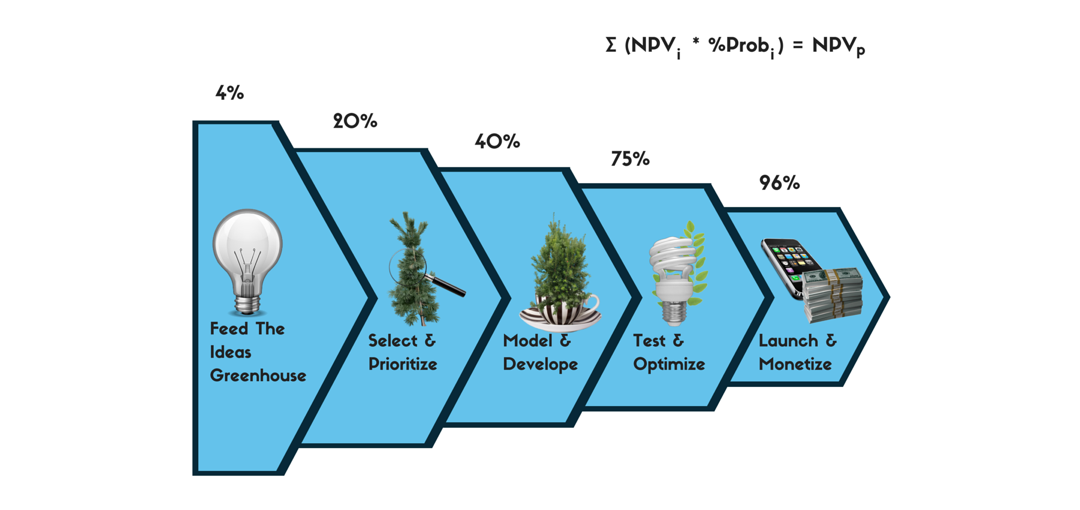

An idea just captured, for example, has an approximate return that’s very low (e.g. NPV calculated based on future cash flow), and the probability that this idea will be implemented after passing through the “funnel” is also very low. But the value of an idea about to materialize, which is in advanced stages of incubation, offers much better potential return, and the probability of implementation is very high. So the value of a portfolio can be calculated as the sum of the return of each project at each stage, multiplied by the probability that the project comes to fruition (the “conversion rate” of each stage of the funnel of projects).

For example, we could calculate the “expected value” of return using the NPV (net present value) of the entire portfolio, VANp. We could also apply the same formula using the IRR, EBITDA, ROI or other indicators of return.

Return on Investment in Innovation (ROI2)

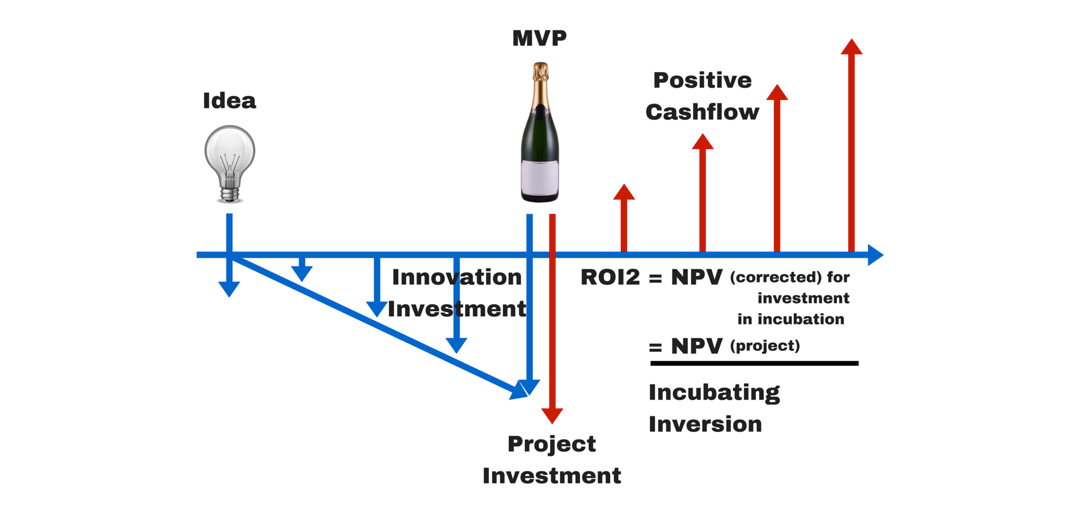

It’s also important to measure the efficiency and quality of an innovation management process. This relates to the investment made to process the portfolio of ideas, where some ideas are realized, and resources and risk can be accurately assessed.

In the example above, we must compare the expected return of the portfolio of projects, VANp, with the investment in innovation management (human resources required for innovation, including the cost of prototyping and testing, consulting and studies, a crowdsourcing innovation platform, value of direct and indirect work hours of all internal and external personnel involved in the incubation and development of the project, among others).

Using ROII or ROI2 (Return on Innovation Investment) offers indicators that can be calculated in several ways. In the example, two forms of ROI2 calculations are shown: One “correcting” the NPV of a project (adding investment in incubation as an initial negative cash flow of the project), and another calculating the NPV ratio of the project vs an investment incubation project. These two measures also track the effectiveness and efficiency of the process and methodology of idea management itself.

To make innovation efforts understood and appreciated in companies, there are clearly two things that need to happen: always place a value on the ideas and projects, regardless of stage, and ensure that the cost of developing them is covered by them. Otherwise, all the innovative effort your company is committing will not make sense to the direction of the company, and it certainly won’t make sense to the shareholders. Nor should it!